Press Release

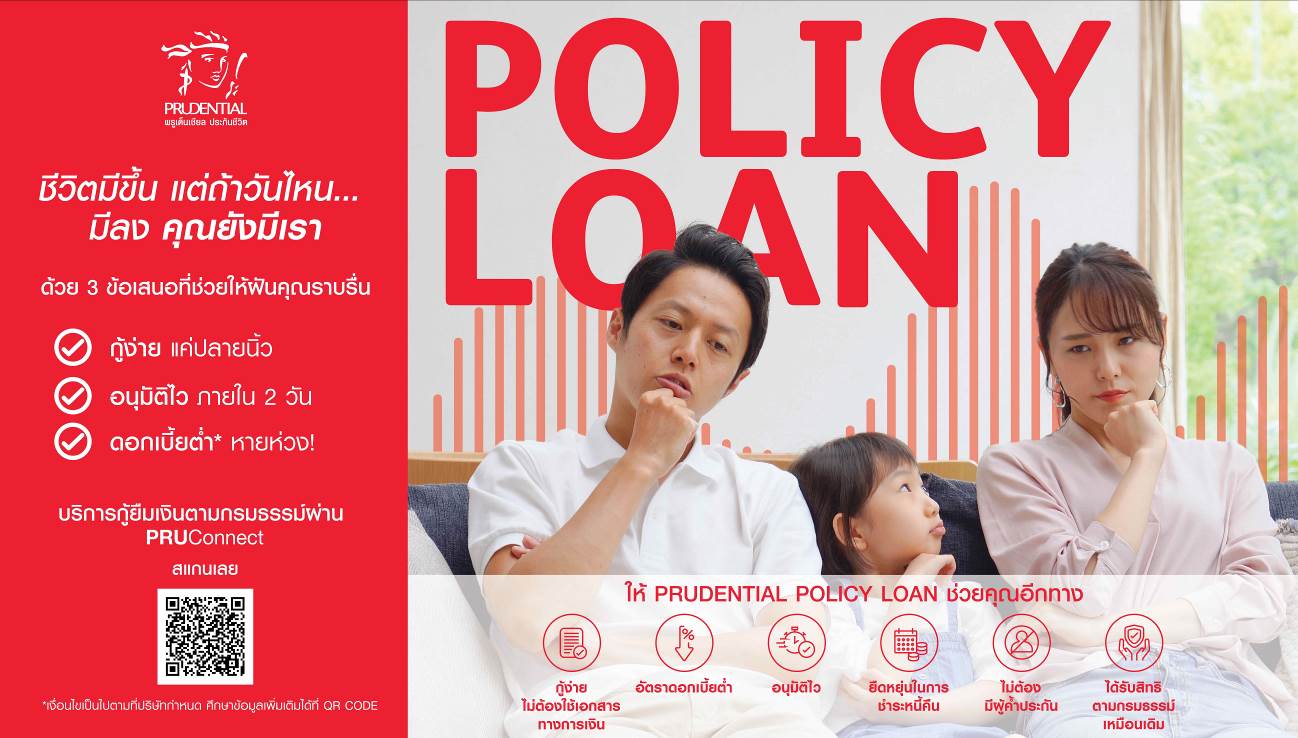

Prudential Thailand launches ‘Digital Policy Loan’ service

Digital financial assistance service available online 24/7

Bangkok, Thailand, 16 November 2021 – Prudential Life Assurance (Thailand) Public Company Limited (Prudential Thailand) is launching a digital ‘Policy Loan’ service that will provide customers with added peace of mind and resources as needed.

The service is part of Prudential Thailand’s commitment to improving the overall digital customer experience on its various platforms for the better wellbeing of all customers.

Prudential Thailand believes that as a leading insurance company in Thailand it has a responsibility to make a positive contribution to Thai society. The wellbeing of Thai people and its customers continues to be the company’s primary focus as it develops products and adds resources to help all cope with impact of the ongoing COVID-19 pandemic.

Ms. Pasalaree Theerasas, Chief Customer Officer, Prudential Thailand, said, “Since the beginning of the pandemic, Thai society has faced health and wellbeing challenges. This is especially acute because of financial stress.

“Prudential Thailand is committed to safeguarding the health and wellbeing of the Thai people. Our Digital Policy Loan service supports all customers”.

Customers can request to receive a lump sum loan by accessing its e-submission system on PRUConnect via the Prudential LINE Official Account that runs around the clock, seven days a week. The application requires no financial documents or guarantor, with the e-application processed and approved within two business days.

The Policy Loan service eases the ‘pain points’ of borrowing or other issues related to complicated document preparation and the often-lengthy loan approval time after submission. Other benefits include low interest rates, and flexible loan repayments in addition the usual policy benefits.

The service is available to Prudential Thailand customers aged 20 years or older with cash value policies and goes live from today. They are invited to self-check the loan amount and interest rates available via PRUConnect on the Prudential LINE Official Account. *

For further information, please contact Prudential Thailand’s Customer Service Center 1621.

* Rights and conditions are as specified by the Company.

###

ABOUT PRUDENTIAL IN THAILAND

Prudential has operated in Thailand for more than 25 years through Prudential Life Assurance (Thailand) Public Company Limited. Prudential serves more than 1.6 million customers in Thailand and manages more than Thai Baht 115 billion of assets on their behalf. In 2021 the Thailand business grew IFRS operating profits by 33 per cent to USD 101 million and Life Weighted Premium by 11 per cent to USD 343 million. (30 June 2021 figures).

For information or images about press release, please contact:

| Total Quality Public Relations (Thailand)

Krittipanya Charoensuk (Phoom) Tel. +66 (0) 2260 5820 ext. 121 / 092 492 5565 Email: phoom@tqpr.com |

Prudential Life Assurance (Thailand) Public Company Limited

Vararat Chevavichavankul / Nitipong Srisoontaraporn Tel. 09 3956 5563 / 0 6363 22 999 |