Stripe Unveils Features For Businesses in Thailand

To Monetize New Business Models, Reduce Costs And Grow Revenue

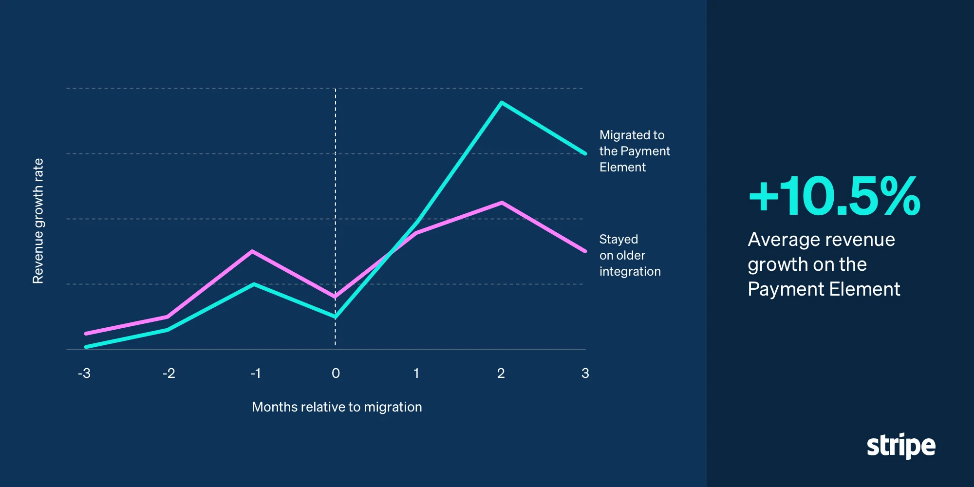

- Businesses using Stripe’s newest payment integration–the Payment Element–saw a 10.5% increase in revenue on average

Bangkok, 10 May 2023 – Stripe, a financial infrastructure platform for businesses, has unveiled several features to help businesses in Thailand monetize new business models, grow revenue and reduce costs, as part of its recent annual product showcase, Stripe Sessions

In the face of continued economic headwinds, businesses around the world have responded by focusing on creating new revenue streams, instead of just reducing costs. A recent survey found global business leaders indicated they were equally focused on actively reaching out to new customers and investing in new product features (51%), beyond reducing costs ( 49%). While global economic uncertainty remains high, Thai businesses could also focus on this trend and apply it as a potential buffer against any downturn.

“We see that businesses are not being complacent or satisfied with just cutting costs. They are actively looking for opportunities to increase revenue and grow during a year when the macroeconomy is under intense pressure,” Tee Chayakul, Country Director, Stripe Thailand, said. “Thai businesses can leverage the combined experience of global business leaders together with powerful solutions, to help them quickly grow their income and run their businesses more efficiently.”

Businesses using Stripe’s newest checkout optimizations saw 10.5% more revenue

Stripe’s newest payments integration–the Payment Element–helped businesses grow their revenues by 10.5% on average, compared to similar businesses that remained on an older Stripe integration. The Payment Element is an embeddable and customizable UI component that surfaces the most relevant payment methods and supports more than 100 optimizations in a single integration. These optimizations are also available through Stripe Checkout, a prebuilt, hosted payment page that lets businesses easily and securely accept payments online.

Stripe now offers more than 100 checkout optimizations as part of Stripe Checkout and the Stripe Payment Element, including pre-built payment UIs, more than 40 payment methods, and one-click checkout to increase revenue. In the last year alone, more than 100,000 businesses including OpenAI (the company behind ChatGPT) and BigCommerce upgraded to Stripe’s new, highly-optimized checkout products to increase conversion.

Global businesses are using Stripe to reduce payment costs and innovate

One example of how Stripe is helping companies reduce payments costs and giving customers more ways to pay is its recently announced global partnership expansion with Uber Technologies, Inc. Under the agreement, Uber expands its strategic payments partnership with Stripe across its top markets, including Australia, Japan, Europe, and the US.

Stripe also announced a new partnership with Microsoft to enable businesses in North America to accept payments directly in Microsoft Teams. With virtual communication being a significant part of the new normal, the Microsoft Teams collaboration platform offers video conferencing, voice, messaging, and other embedded tools to more than 300 million global businesses. Stripe will power Teams Payments, allowing meeting hosts to accept real-time card payments during virtual appointments, classes, events, and more. Businesses can even set advance payment through Stripe as a requirement to join a Teams session.

Bringing all of Stripe’s best to Thailand in the long run

“We are excited to bring all of Stripe’s best features to Thailand in the long run, especially as we build out our global payment and treasury networks, the infrastructure that powers commerce across the digital economy. While these recent announcements are all very exciting, there is still a lot of work ahead and we cannot wait to show what else we have in store for payment leaders, finance executives, and startup founders in Thailand,” Tee, added

###

For media information, please contact:

TQPR Thailand

Maetavarin Maneekulpan

mae@tqpr.com

662 260 5820